Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

⚠️ Important Update (16 June 2025)

In one of my previous blog posts titled How to Earn 16 Binance Alpha Points Daily in Malaysia I shared how I used ZKJ swaps with low gas fees to farm Binance Alpha Points on Binance.

However, due to the ZKJ flash crash on 16 June 2025, this strategy is no longer effective. The crash has severely impacted ZKJ’s liquidity, trading volume, and price stability which makes the previous swap-based method for earning Alpha Points no longer viable at this time. Please exercise extra caution and always verify market conditions before attempting similar strategies.

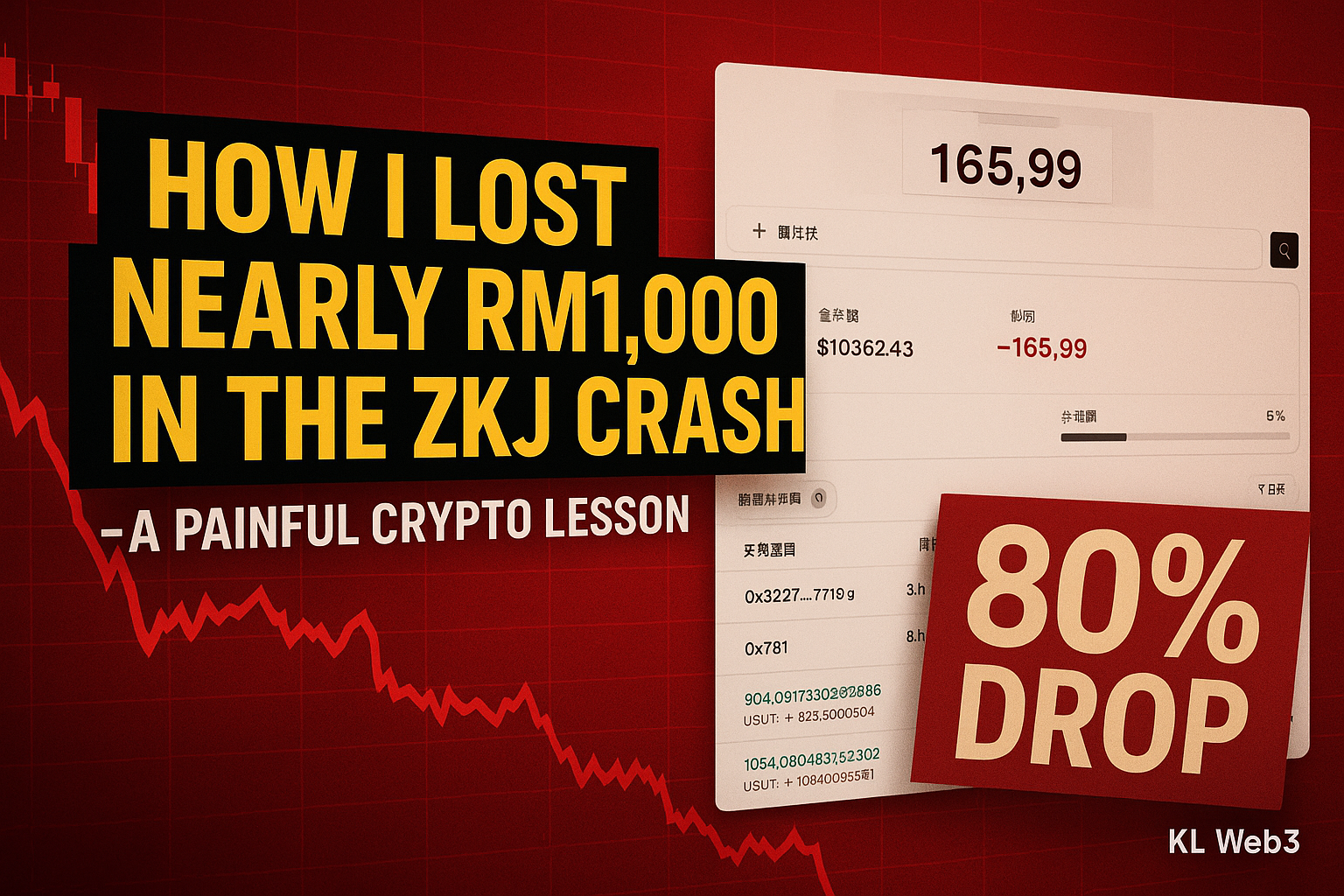

Today, the crypto community witnessed one of the most dramatic single-day crashes in recent months. Polyhedra Network’s token (ZKJ) suffered a massive price collapse that wiped out over 80% of its market cap in just a few hours.

At KL Web3, we want to break down what really happened, why it matters, and most importantly, share valuable lessons for everyone in the crypto space.

The ZKJ/USDT pair crashed from above $1.90 down to nearly $0.70 within a very short time, creating panic across many exchanges and communities. Based on the on-chain data and expert analysis circulating on platforms like Twitter, here’s a simplified explanation of the chain of events:

Liquidity Drain Trigger

The event started when a large wallet pulled significant liquidity from a related token (KOGE/USDT pool). This action started to impact other pools connected via liquidity pairs, especially ZKJ.

Coordinated Whale Dump

Following the initial liquidity drain, multiple large wallets (whales) started selling off massive amounts of ZKJ tokens.

Flash Liquidations

As the price fell, many traders who were using leverage (margin trading) got liquidated automatically. Over $94 million USD in liquidations occurred in ZKJ alone during the crash. This liquidation cascade further accelerated the price drop.

Token Unlock Pressure

Around the same period, a scheduled unlock of 15.5 million ZKJ tokens (approximately $30 million USD worth) added even more supply into the market. This sudden increase of tokens available for sale amplified the bearish momentum.

Market Panic

With prices crashing and liquidations piling up, retail traders panicked, leading to even more selling pressure. This turned it into a classic flash crash scenario.

To give you a clearer picture, let me share my personal trade record from this ZKJ crash.

In one of my trading accounts, I lost approximately $165.99 USD, which is equivalent to around RM746.95 in Malaysian Ringgit.

However, this is only part of the story. I still have another account where I’m holding ZKJ, currently showing an unrealized loss of about $50 USD. When combined, my total loss from this crash adds up to roughly RM1,000.

To put this into perspective, this amount could have paid for at least 27 sets of KFC Malaysia Father’s Day Promo (9-piece meal), based on my recent post:

👉 How I Used Cypher Virtual Card to Pay for KFC Malaysia Father’s Day Promo — Real Web3 Use Case

Even though this is a relatively small amount compared to the overall market loss, it shows how unpredictable and dangerous these flash crashes can be. No one is fully immune, even when practicing proper risk management.

Many newcomers to crypto might think that projects backed by major exchanges, big airdrops, or strong narratives are safe bets. However, today’s ZKJ incident is a painful reminder that:

We have seen similar stories in the past, whether it was Luna/UST in 2022 or recent sharp drops in other DeFi tokens.

At KL Web3, we always remind our readers:

Unlike in 2020-2021 where everything went up, the current crypto market is much more complex.

Smart money moves fast.

Whales control significant liquidity.

Tokenomics (unlocks, vesting, emissions) play a huge role in price stability.

Retail traders often enter too late and exit too early.

This is no longer the easy money bull run like before.

The ZKJ flash crash today is a strong wake-up call for everyone in Web3.

At KL Web3, we will continue to monitor market developments, provide educational content, and help Malaysian and regional traders navigate the ever-evolving crypto landscape with more caution and wisdom.

Stay safe, trade smart.

If you found this post useful, feel free to share with your friends or join our KL Web3 community for more real-time updates and analysis.

#KLWeb3 #ZKJ #CryptoCrash #CryptoRisk #Polyhedra #CryptoEducation #DYOR #MalaysiaCrypto

The content provided in this article is for informational and educational purposes only. It does not constitute financial, investment, legal, or other professional advice. Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. You should carefully consider your investment objectives, level of experience, and risk appetite before trading cryptocurrencies. Always do your own research (DYOR) and consult with a licensed financial advisor if necessary. KL Web3 and the author are not responsible for any losses or damages that may arise from your trading activities.